Put call options bonds

Tax Treatment For Call & Put Options | Investopedia

A callable bond also called redeemable bond is a type of bond debt security that allows the issuer of the bond to retain the privilege of redeeming the bond at some point before the bond reaches its date of maturity. Technically speaking, the bonds are not really bought and held by the issuer but are instead cancelled immediately. The call price will usually exceed the par or issue price. In certain cases, mainly in the high-yield debt market, there can be a substantial call premium.

Puttable bond - Wikipedia

Thus, the issuer has an option which it pays for by offering a higher coupon rate. If interest rates in the market have gone down by the time of the call date, the issuer will be able to refinance its debt at a cheaper level and so will be incentivized to call the bonds it originally issued.

With a callable bond, investors have the benefit of a higher coupon than they would have had with a non-callable bond. On the other hand, if interest rates fall, the bonds will likely be called and they can only invest at the lower rate.

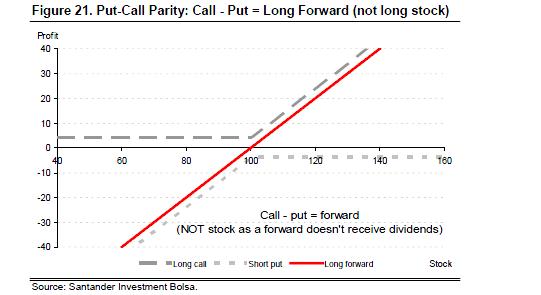

This is comparable to selling writing an option — the option writer gets a premium up front, but has a downside if the option is exercised.

Call Option vs Put Option - Difference and Comparison | Diffen

The largest market for callable bonds is that of issues from government sponsored entities. They own a lot of mortgages and mortgage-backed securities. If rates go down, many home owners will refinance at a lower rate. As a consequence, the agencies lose assets. By issuing a large number of callable bonds, they have a natural hedge, as they can then call their own issues and refinance at a lower rate.

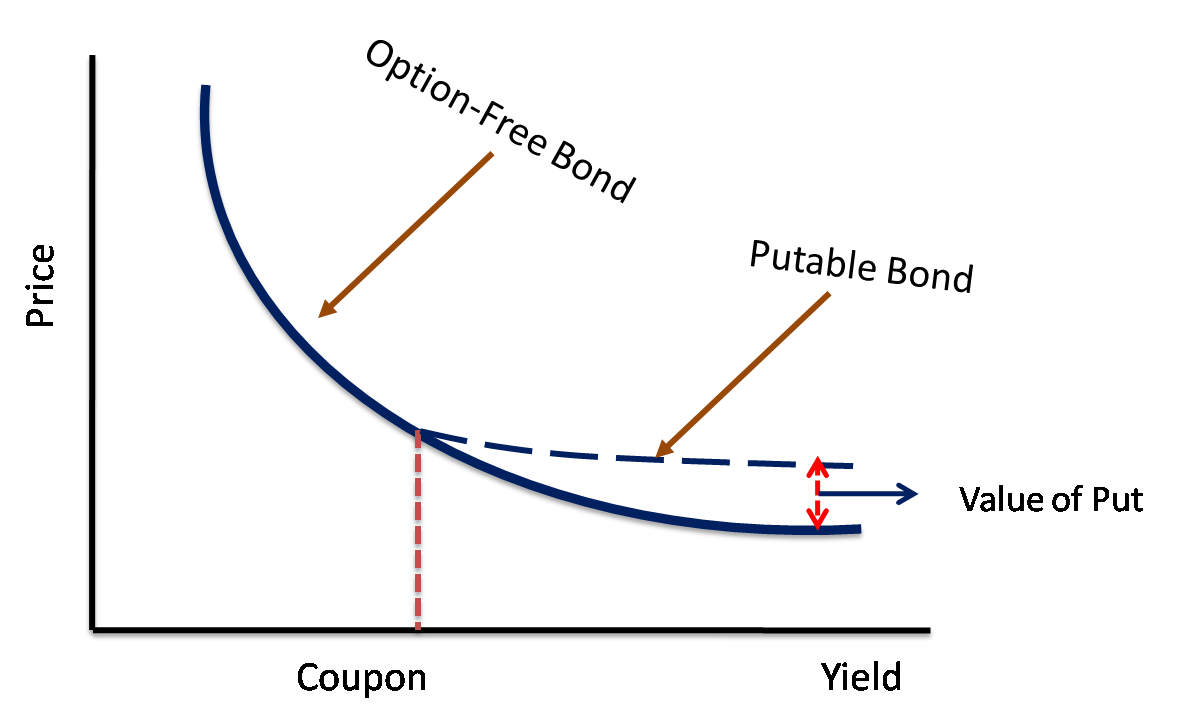

The price behaviour of a callable bond is the opposite of that of puttable bond. Since call option and put option are not mutually exclusive , a bond may have both options embedded. From Wikipedia, the free encyclopedia. Bond Debenture Fixed income.

Agency bond Corporate bond Senior debt Subordinated debt Distressed debt Emerging market debt Government bond Municipal bond.

Accrual bond Auction rate security Callable bond Commercial paper Contingent convertible bond Convertible bond Exchangeable bond Extendible bond Fixed rate bond Floating rate note High-yield debt Inflation-indexed bond Inverse floating rate note Perpetual bond Puttable bond Reverse convertible securities Zero-coupon bond.

Clean price Convexity Coupon Credit spread Current yield Dirty price Duration I-spread Mortgage yield Nominal yield Option-adjusted spread Risk-free bond Weighted-average life Yield curve Yield spread Yield to maturity Z-spread. Asset-backed security Collateralized debt obligation Collateralized mortgage obligation Commercial mortgage-backed security Mortgage-backed security.

Callable bond Convertible bond Embedded option Exchangeable bond Extendible bond Puttable bond. Commercial Mortgage Securities Association CMSA International Capital Market Association ICMA Securities Industry and Financial Markets Association SIFMA. Retrieved from " https: Bonds finance Options finance. Navigation menu Personal tools Not logged in Talk Contributions Create account Log in.

Views Read Edit View history.

Navigation Main page Contents Featured content Current events Random article Donate to Wikipedia Wikipedia store. Interaction Help About Wikipedia Community portal Recent changes Contact page.

Tools What links here Related changes Upload file Special pages Permanent link Page information Wikidata item Cite this page. This page was last edited on 21 December , at Text is available under the Creative Commons Attribution-ShareAlike License ; additional terms may apply.

By using this site, you agree to the Terms of Use and Privacy Policy. Privacy policy About Wikipedia Disclaimers Contact Wikipedia Developers Cookie statement Mobile view.