New york stock exchange shareholder approval

Words Of Wisdom

It is Maxwell Smart, General Counsel of your client, CONTROL, Inc. We want you to be prepared when Max calls you back, so here is an overview of the NYSE and Nasdaq shareholder approval rules.

Some things to keep in mind about the NYSE rules. These exceptions do not apply to issuances that would result in a change of control. Here are a few of the complexities:.

Glossary - Aviva plc

Summary of the Nasdaq shareholder approval rules. By the way, remember that effective April 13, , Nasdaq reorganized its rules.

The New York Times - Wikipedia

Some things to keep in mind about the Nasdaq rules. The financial viability exception to both the NYSE and Nasdaq rules. Under both the NYSE and Nasdaq rules, a company using this exception must mail a notice to its stockholders not later than ten days before the issuance to alert them that the company is using the exception with the approval of its audit committee.

Among other things, you will need to work closely with the NYSE or Nasdaq to get approval in advance, and that approval is not easy to obtain. Both NYSE and Nasdaq will expect a showing that the delay in obtaining shareholder approval will create a very real risk of bankruptcy.

New York REIT to Liquidate (NYRT) | Investopedia

Note that there is no comparable provision under the Nasdaq rules. The US Securities Laws: Commentary on the Law and the Lore.

Client Alerts News and analysis that tell you what you need to know about recent regulatory developments Guides Plain-English comprehensive guides covering major areas of the capital markets Tools Desktop references, online dictionaries, and flow charts that help get you to an answer WoWs Short posts documenting some of the interesting securities law questions we have encountered.

Here are a few of the complexities: Public offerings in this context require an actual marketing process that results in a price for the deal.

We discuss Nasdaq in Part II. Some things to keep in mind about the Nasdaq rules There are some important points to note on the Nasdaq rules: For all calculations under the Nasdaq rules: Nasdaq has explained that a broadly marketed firm commitment underwritten securities offering registered with the SEC is generally a public offering, as is any other registered offering that is publicly disclosed and distributed in the same general manner and extent as a firm commitment underwriting.

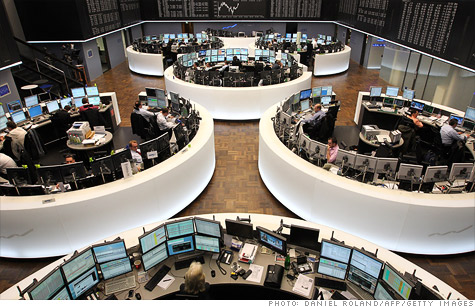

Tense trading at NY Stock ExchangeTo take advantage of this exception, a company has to show that: You May Also Be Interested In. FINRA Issues Exchange Act Reporting.