Semi strong form stock market efficiency

Semi-Strong Form Efficiency

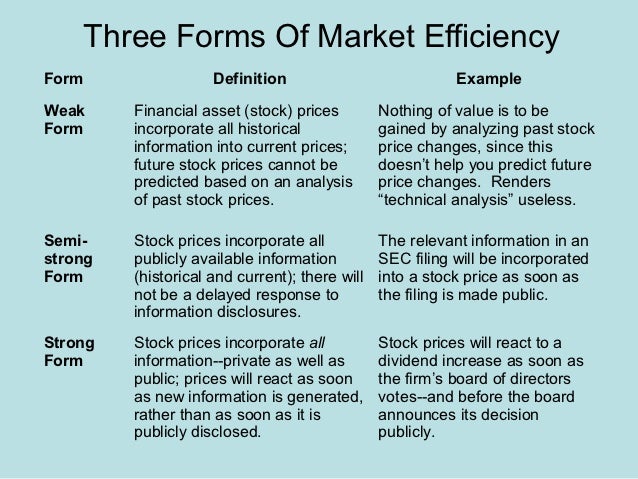

Semi-strong form of market efficiency is when prices already reflect all publically available information and it is not possible to earn excess return by fundamental analysis. Semi-strong form of market efficiency lies between the two other forms of market efficiency, namely the weak form of market efficiency and strong forms of efficient market efficiency.

When a market is semi-strong form efficient, neither technical analysis nor fundamental analysis can help predict future price movements.

However, non-public information can be used to earn above average return. Alex held shares of Cure Inc.

Alex is not an active investor so he does not checks the stock performance daily. On 14 January Sunday , he came across an article shared by his friend on Facebook.

The article was published on 11 January Friday. According to the article, Cure Inc.

Total outstanding shares of Cure Inc. He is wondering what happened.

Weak, Semi-Strong and Strong EMH

The market seems to be semi-strong form efficient. The market had adjusted itself to the public information on Friday 11 January as soon as the market came to know about it.

Alex should not have used this public information to project a decline on Monday. Written by Obaidullah Jan. Subjects Accounting Economics Finance Management.