Knock out put option payoff

In the over-the-counter OTC market , virtually every term of option contracts is negotiated, but this greatly reduces liquidity of the option. To increase liquidity and trading activity, organized exchanges standardized the terms of option contracts, such as the number of shares that each contract represents, or the strike prices that are allowable. Most option contracts traded on exchanges are just called puts and calls, and, in most cases, the trader simply specifies strike price, expiration month, and quantity.

However, there are some contracts that differ significantly from the standardized options traded on exchanges, but that have terms common enough to warrant their own names, and are grouped under the genus exotic options , contrasting them to the standardized vanilla options , sometimes called more verbosely as plain-vanilla options. Exotic options , traded in the OTC market, are either variations of the simple call and put options traded on organized exchanges, and usually have a European-style exercise option, when the option can only be exercised at or near the end of the contract term, or they are structured products with an optional component.

Structured products are financial instruments that were created to satisfy a need for hedging under specific circumstances, and usually involves the use of derivatives.

Call payoff diagramMost exotic options are foreign-exchange options aka FX options , and provide better hedging characteristics for certain business activities involving foreign exchange, but may be used by speculators for profit as well.

Most FX options involve currency pairs where at least 1 of the currencies is a minor currency. Some of these options may be extremely volatile because of economic instability or political unrest in the country of the minor currency.

The following explains the most common exotic options, but is, by no means, a complete list. Basket options give the holder the right to receive 2 or more foreign currencies for a base currency for a designated or spot rate.

Compound options are options on options that give the holder the right to acquire another option by a specific date and for a specific premium. There are calls on calls, puts on puts, calls on puts, and puts on calls.

Compound options are used by corporations to hedge foreign exchange risk for a business venture that may or may not occur.

Bermuda options have an exercise option that is somewhat between that of American- and European-style options. Supposedly, the name Bermuda derives from the island's location between the United States and Europe. Whereas an American-style option can be exercised any time before expiration and a European option can only be exercised on or near the expiration date, a Bermuda option can only be exercised on specific days before expiration or on the expiration date.

For instance, a Bermuda option may allow exercise only on the 1 st day of each month before expiration, or on expiration. Every other characteristic of a binary option depends on the contract on which it is based, which, in turn, depends on the writer of the contract, or, with a standardized contract, upon the standard set by an exchange.

Most binary options are not classified as puts or calls. Although there are exceptions, little is gained by classifying a binary option as a put or call since each option has only 2 possible values at expiration.

Instead, a typical binary option is in the money if the price of the underlying is either at the strike price or above. The maximum potential loss for the long trader is the premium paid for the option. If the trader expected the price of the underlying asset to decline, then, rather than buying a put, the trader would simply sell the binary option, taking the short position. If the trader expected the price to increase beyond a certain level by a certain time, then the trader would buy the binary option with a strike price equal to the minimum expected price at expiration.

Before trading binary options, read this: Binary Options and Fraud Investor. Best-of-two options depends on 2 different securities or indexes; and better-of-two options pays off according to the better performing security or index. An Asian option synonyms: A business would use this option to hedge against price increases or decreases over a certain period, but must buy and sell the underlying asset every day or more frequently than the available expiration dates for options or futures.

Asian options pay off according to the following formula:. A ladder option synonyms: A lookback option pays according to the highest value reached by the underlying during the contract period. Some lookback options use the highest value reached by the underlying during the contract period to determine the amount of settlement.

One formula for the lookback is:. A lock-out option pays if the value of the underlying does not go beyond a specified value. A double-lockout option pays if the value of the underlying asset remains confined within a specified range. A range-accrual option is similar, but it pays according to how many days the value of the underlying asset was above or below a specified value, or was confined within a specified range.

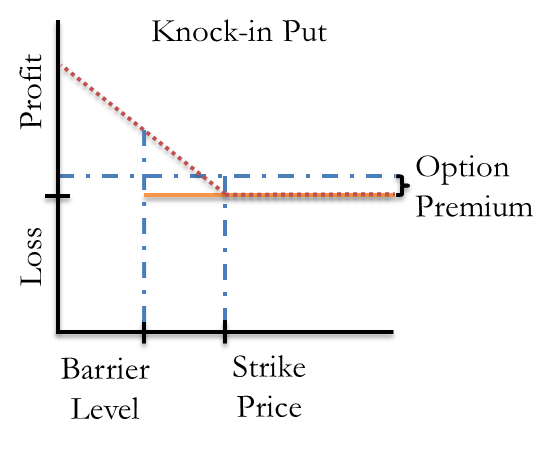

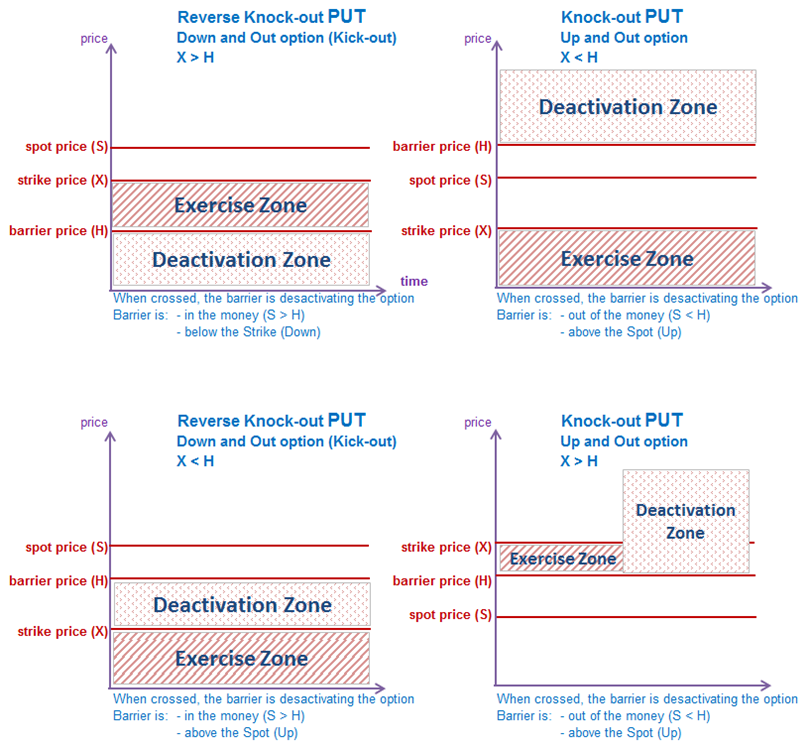

Barrier options pay off if an asset reaches a certain price. Knock-in options are created with predetermined characteristics when the underlying reaches a certain price. Knock-out options are options that terminate if the underlying reaches a certain price. Since the option ceases to exist, there is no payoff even if the price moves back within the knock-out barrier before the original expiration. Thus, an option with a knock-out barrier has a maximum specified value and payoff.

Knock-In Option

Single-barrier options have a single trigger price that is either above or below the strike price, and double-barrier options have trigger prices that are above and below the strike price. Because the option may either not come into existence or pass out of existence, barrier options are generally cheaper than standard options, with the double-barrier option being cheapest.

Option — Wikipédia

Most exotic FX options are barrier options. A double-trigger option , often used for insurance purposes, pays off only if 2 events occur. A company or an insurance company will buy this option to limit losses that are very unlikely, but would be very expensive if they both occurred.

An example would be if a company had a large property loss in a foreign country where changes in the foreign exchange rate made the loss much more expensive. Weather options pay off for unusual weather. Many businesses that are affected by the weather, such as utilities and ski resorts, use these options to keep cash flow more consistent.

Personal Finance Bankruptcy Chapter 7 Chapter 13 Chapter 11 Credit and Debt Debt Collection Insurance Types of Insurance Auto Homeowner Health Life Real Estate Taxes Income Taxes Personal Deductions and Tax Credits Retirement Plans Gratuitous Transfer Taxes Educational Tax Benefits Taxation of Investments Business Taxes Wills, Estates, and Trusts Wills and Estates Trusts Investments Investment Fundamentals Investment Funds Mutual Funds Limited Partnerships Banking Bonds Types Of Bonds Government Securities Money Market Instruments Corporate Bonds Asset Backed Securities Forex Futures Options Stocks Stock Indexes Stock Valuation and Financial Ratios Technical Analysis Economics.