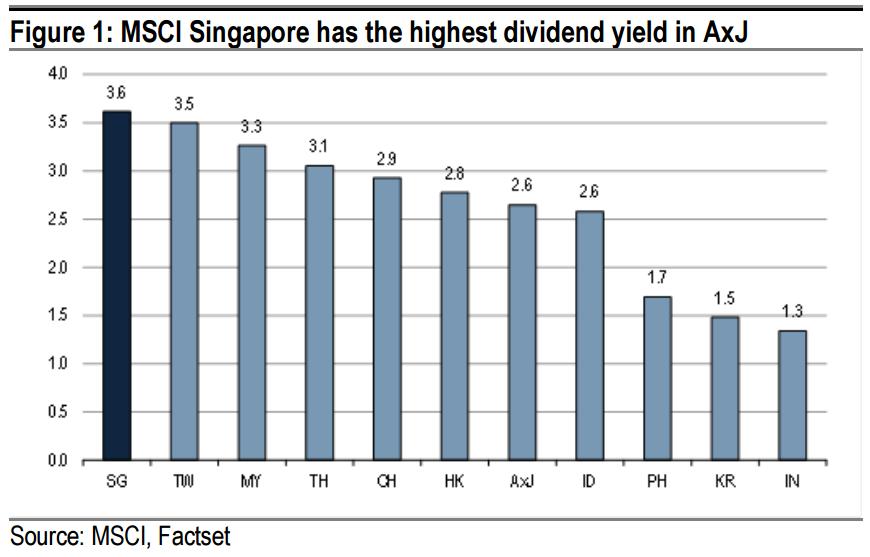

Singapore stock market yield

With these kinds of dividend yields, you can potentially create a portfolio of dividend stocks that provides an income to. If you bookmark the Dividend Stock Tracker or have it on frequently, you will be able to know what is the estimated dividend yield of the stock based on the latest prices of the dividend stock.

Asia’s Highest Dividend Yields In Singapore – seboxinero.web.fc2.com

However, stocks that are reported in other currency for example Fortune REIT in Hong Kong dollars the ratios and revenues are recorded in Hong Kong dollars. This is because in Singapore, company release their results quarterly. If there is a dividend declared, we will only know it on a quarterly basis. Once we see it we update it. This may be due to a record good year last year which is likely not to be repeated this year. The criteria are not very fix. They are based on my analysis of the industry group and stocks operating environment:.

The main page will show the dividend stocks and their price changes. The dividend and dividend yield columns will display the historical dividend declared and the yield based on current price. Post this date, you are not eligible.

Singapore Stock Market (STI) | | Data | Chart | Calendar

Investors can go to SGX. At my dividend stock tracker. You can then forecast whether you should take notice of the stocks in anticipation of getting in for the dividends. The dates and amount is based on historical declaration.

Dividends are discretionary and a company can change their dividend policy readily. Simply click on the dividend stock and hold your mouse cursor still. You will see a detail description of the dividend stock. At the bottom there will be two information, computed dividend and ex dividend dates and its corresponding amount.

Some stocks may not distribute uniformly some quarters are larger than other quarters so that is why i have a computed dividend to tell users how i come up with my dividend figures. Focusing on that metric alone will get you burn.

There are some examples in the past here and here that stock markets screener european company with high dividend yield but share price keeps falling. Viewers will see typically 3 kinds of yields on the stocks i screen. Earnings yield, Dividend payout Yield and Free Cashflow Yield. What is the difference between the 3 of them?

Which one is better for dividend yield stock analysis? Free Cash Flow for dividend stocks are as important as earnings in telling you if the dividends are sustainable or whether the stock can actually payout more.

High dividend yield is not always ideal. What matters more is the sustainability of dividends in the long run. In this article, we assess the sustainability of dividends using free cash flow, free cash flow margin and dividend payout of free cash singapore stock market yield. Kyith Ng is the founder of Investment Moats, which mentors you on wealth management towards Financial Independence.

Investment Moats shows how you can build wealth through stock market investing, dividend income investing through a value based approach. And then to distribute wealth.

At the start of 32 years old, I set a 10 year target of how much cp cheats moneymaker Wealth Fund to accumulate by singapore stock market yield of 41 years old.

Purely savings, inclusive of company units from employment. About SGX Dividend Stock Tracker click to see Tracker in Full. About Investment Moats Kyith Ng is the founder of Investment Moats, which mentors you on wealth management towards Financial Independence Investment Moats shows how you can build wealth through stock market investing, dividend income investing through a value based approach.

Be enlightened on how you can live a fulfilling life while building wealth. Subscribe to Investment Moats to Level Up Your Wealth Management Today.

SGX:Singapore Stock Quote - Singapore Exchange Ltd - Bloomberg Markets

I share more of the nuances that keeps me alive in wealth building and life on Facebook! Best Articles I built my Wealth by following this Wealthy Formula Singapore High Yield Dividend Stocks for Income Should you buy Blue Chips at ANY price?

Get Rich — Pay Yourself First Free Online Stock Investment Portfolio Spreadsheet 5 Steps to Compound Wealth via Dividend Income My Insurance Philosophy How much u need to reach Financial Independence? Stock Valuation and Fundamental Analysis How does price and dividend affect each other? Understanding how Free Cashflow works Net Profit, EBITDA, Operating Cashflow and Free Cashflow in Dividend Investing Choosing the best high yield dividend stocks for your portfolio Stock Buybacks and Dividends: Are they good or bad?

How to analyse an airline stock Find the Dividend Cash King among telecom. Blogroll 8percentpa Drizzt's Income Investing Eat Dream Love — SG Premier Travel Food Review Blog Giraffe Value My 15 Hour Work Week SG Invest Bloggers The Finance SG. Money Management Budget Babe of Singapore Bully The Bear DIY Insurance — Insurance your own way Heartland Boy Invest Moolah Kay Money Talk My Housing Loan. SG SG Wealth Planner Singapore High Yield Income Investing Singaporean Stock Investor Wealth Buch Wealth Journey.

Value Investing Donmihaihai Margin of safety Musicwhiz Value Investment Re-ThinkWealth SG Dividends SG ThumbTack Investor Small Cap Asia The Asia Report Value Edge.