Using moving averages to buy stocks

Moving average lengths are variable, but common parameters include 10, 20, 50, and days. Varied lengths can create different trend indications, but shorter periods will react faster to price changes. A simple moving average , or SMA, adds the five most recent daily closing prices and divides the total by five to create a new average each day. The exponential moving average , or EMA, applies more weight to recent prices. A day EMA will react more quickly to price changes than a day SMA.

Trending Stocks - seboxinero.web.fc2.com

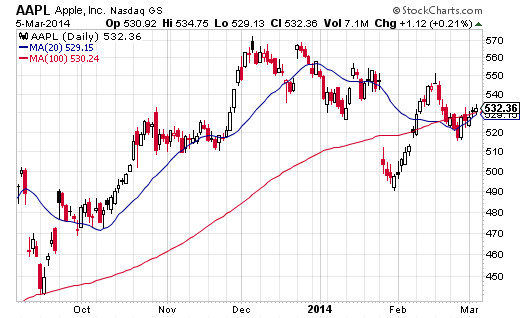

Generally, a stock is trending up if its price is above a moving average. A stock is shifting trends if its price crosses above or below a moving average. One common strategy is to chart two moving averages of different lengths.

Moving averages cannot predict stock performance. For more information, see How to Use a Moving Average to Buy Stocks. Dictionary Term Of The Day.

A measure of what it costs an investment company to operate a mutual fund. Latest Videos PeerStreet Offers New Way to Bet on Housing New to Buying Bitcoin?

Buy and Hold These 3 Dividend Stocks Forever di – Investors Alley

This Mistake Could Cost You Guides Stock Basics Economics Basics Options Basics Exam Prep Series 7 Exam CFA Level 1 Series 65 Exam. Sophisticated content for financial advisors around investment strategies, industry trends, and advisor education.

Moving Averages - Simple and Exponential [ChartSchool]

Use Moving Averages to Buy Stocks Share. Learn how to use moving averages to enter and exit trades in ETFs, and understand some popular technical setups using moving averages.

The Moving Average indicator is one of the most useful tools for trading and analyzing financial markets. The moving average is easy to calculate and, once plotted on a chart, is a powerful visual trend-spotting tool.

These technical indicators help investors to visualize trends by smoothing out price movements. A death cross is seen when the short-term moving average of a security or index falls below its long-term moving average.

Should investors be worried? An expense ratio is determined through an annual A hybrid of debt and equity financing that is typically used to finance the expansion of existing companies.

A period of time in which all factors of production and costs are variable. In the long run, firms are able to adjust all A legal agreement created by the courts between two parties who did not have a previous obligation to each other. A macroeconomic theory to explain the cause-and-effect relationship between rising wages and rising prices, or inflation.

Moving Averages with Penny Stock TradingA statistical technique used to measure and quantify the level of financial risk within a firm or investment portfolio over Content Library Articles Terms Videos Guides Slideshows FAQs Calculators Chart Advisor Stock Analysis Stock Simulator FXtrader Exam Prep Quizzer Net Worth Calculator. Work With Investopedia About Us Advertise With Us Write For Us Contact Us Careers. Get Free Newsletters Newsletters.

All Rights Reserved Terms Of Use Privacy Policy.