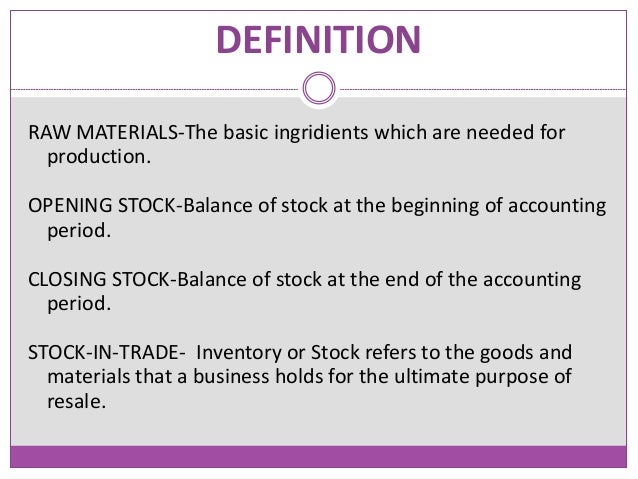

Definition of forex terms

From beginners getting acquainted with the world of investing to experts with decades of experience, all traders need to clearly understand a huge number of terms. When one company decides to take over another one, it is referred to as an acquisition.

The acquiring company will do this by purchasing either the majority or entirety of the ownership stake of the company being taken over. IG alerts — also known as trading alerts — allow you to set specific criteria and be notified immediately once that criteria has been met.

There are three main types: Arbitrage refers to the practice of buying an asset then selling it immediately to take advantage of a difference in price. The ask refers to the price at which you can buy an asset or security from a seller. It can be variously referred to as ask, the ask, or asking price. The various types of financial instruments are called asset classes, and they come under four broad categories. Asset classes are defined by the similar characteristics of the instruments within them, such as behaviour on the market, laws and regulations.

Assets can be defined in two ways in trading, dependent on whether they are in connection with a company or a financial instrument. In trading, an auction or auction market refers to the process by which the prices of shares are determined before the open, after the close, or during intraday volatility auctions to build or stabilise the order book.

They allow traders to place market or limit orders directly on an exchange. Automated trading — also known as algorithmic trading — is the use of algorithms for making trade orders. In trading the term base currency has two main definitions: The base rate, or base interest rate, is the interest rate that a central bank — like the Bank of England or Federal Reserve — will charge to lend money to commercial banks.

It is equal to one hundredth of one percent, or 0. Bears are traders who believe that a market, asset or financial instrument is going to head in a downward trajectory. When the market is on a sustained downward trajectory, with little optimism from traders to bring about a rally, it is referred to as a bear market. In trading and investing, the bid is the amount a party is willing to pay in order to buy a financial instrument.

Blue chip stocks are the shares of companies that are reputable, financially stable and long-established within their sector. Bollinger bands are a popular form of technical price indicator. They were developed by a pioneering technical trader called John Bollinger in the s. Bond trading is one way of making profit from fluctuations in the value of corporate or government bonds. Many view it as an essential part of a diversified trading portfolio, alongside stocks and cash.

Bonds are a form of financial investment that involve lending money to an institution for a fixed period of time. They usually come in two varieties: Variously, it can be used to refer to the net earnings or earnings per share EPS of a business.

Brent crude — also referred to as Brent blend — is one of three major oil benchmarks used by those trading oil contracts, futures and derivatives. A broker is an individual or company that places trades on behalf of a trader.

They can do so in a number of different asset classes, with the most well-known being stockbroking. Bulls are speculators who believe that a market, instrument, or sector is going on an upward trajectory.

When a market, instrument or sector is on an upward trend, it is generally referred to as a bull market. Buying a financial instrument means taking ownership of it from someone else, whether it is a commodity, stock or another asset. Cable is one of a few slang terms for different currency pairs; in this case referring to British pound sterling against the US dollar. Occasionally, people also refer to the price of the British pound as cable.

It can refer to a single project or the entire business. CFD trading is the speculation on financial markets via contracts for difference CFDs , a form of financial derivative.

They are also commonly known as technical analysts, or technical traders. This price is often determined by an auction. A commodity is a basic physical asset, often used as a raw material in the production of goods or services. The cost of maintaining an investment position is often referred to as the cost of carry or carrying charge. It can come in many forms, including interest on margins or the loans used to make the trade, or the cost of storage and insurance associated with holding a commodity.

A covered call is when a trader sells or writes call options in an asset that they currently have a long position on. They are also known as buy-writes. CPI stands for consumer price index, an average of several consumer goods and services that are used to give an indication of inflation.

Crystallisation is the term used when a trader or business closes a position and then reopens an identical position immediately. A currency peg is a governmental policy of fixing the exchange rate of its currency to that of another currency, or occasionally to the gold price. It can sometimes also be referred to as a fixed exchange rate, or pegging.

A day order is a type of order, or instruction from a trader to their broker, to buy or sell a certain asset. Day trading is a strategy of short-term investment that involves closing out all trades before the market closes. It can also sometimes be referred to as a hedge ratio, and is most often used when dealing in options. Deposit margin is the amount a trader needs to put up in order to open a leveraged trading position. It can also be known as the initial margin, or just as the deposit.

A derivative is a financial product that enables traders to speculate on the price movement of assets without purchasing the assets themselves. Because there is nothing physical being traded when derivative positions are opened, they usually exist as a contract between two parties. Digital s are a type of financial derivative, also referred to as digital options or digital bets.

A dividend is the portion of profit that a company chooses to return to its shareholders, usually expressed as a percentage. When trading, DMA stands for direct market access. It is derived from the total amount of profit generated in a period, divided by the number of shares in the company listed on the stock market. When traders talk about the ECB, they are referring to the European Central Bank, the central bank for the eurozone.

EDSP stands for exchange delivery settlement price. It refers to the price at which derivative contracts on exchanges are settled. Equity options are a form of derivative used exclusively to trade shares as the underlying asset. An exchange is a marketplace where financial instruments — such as commodities, stocks, or derivatives — are traded.

They can be either physical, like the New York Stock Exchange, or purely digital like a bitcoin exchange. In trading, execution is the completion of a buy or sell order from a trader. It is carried out by a broker. The point when a trading position automatically closes is known as the expiry date or expiration date.

In trading, exposure is a general term that can mean three things: Fair value has two meanings to investors. Generally, it is used to mean the value attributed to a stock by an individual investor or broker but in futures trading, it can refer to the predicted price of a market which is reflected in the cost to open a position.

It is the successor to the FSA, or Financial Services Authority. It is part of a wider system — known as the Federal Reserve system — with 12 regional central banks located in major cities across the US.

A Fibonacci retracement is a key technical analysis tool, used to gain insight into when to place and close trades, or place stops and limits. Fill is a trading term that refers to the completion of an order to trade a financial asset. Fixed costs are the costs incurred by a company that do not vary with the scale of production. The FOMC, or Federal Open Market Committee, is the branch of the Federal Reserve bank that is in charge of short and long-term monetary policy decisions.

The 'force open' function on the trading platform allows you to enter a new bet in the opposite direction to an existing bet on the same market. Forex is how market participants convert one currency to another.

Forex Trading Glossary, Learn About Currency Trading | seboxinero.web.fc2.com

It can variously be referred to as foreign exchange, FX, or currencies. Forex trading is the act of taking part in the forex market in order to speculate and attempt to make a profit. It can also be known as FX trading, foreign exchange or currencies trading. A forward contract is a contract that has a defined date of expiry. The contract can vary between different instances, making it a non-standardised entity that can be customised according to the asset being traded, expiry date and amount being traded.

Fundamental analysis is a method of evaluating assets on the basis of external events and influences, as well as financial statements on the asset itself. It is used by traders to make decisions on different assets by measuring the economic, financial and market conditions that can affect its price. Futures contracts represent an agreement between two parties to trade an asset at a defined price on a specified date in the future. Gamma is a derivative of delta: Specifically, gamma is the movement of delta in regard to the price of the underlying asset.

GDP stands for gross domestic product, or the total value of the goods and services produced in a country over a specified period. In trading, the handle has two meanings. In most markets, it means the whole numbers involved in a price quote, without the decimals included.

In forex, the handle refers to that part of the quote that appears in both numbers of the spread. A hedge is an investment or trade designed to reduce your existing exposure to risk. The process of reducing risk via investments is called 'hedging'.

High frequency trading or HFT is a form of advanced trading platform that processes a high numbers of trades very quickly using powerful computing technology. It can be used to either find the best price for a single large order, or to find opportunities for profit in the market in real time. In trading, an index is a grouping of financial assets that are used to give a performance indicator of a particular sector. The plural term is indices. Indices trading is the means by which traders attempt to make a profit from the price movements of indices.

Inflation is the increase in the cost of goods and services in an economy. In finance, interest can have more than one definition. Firstly it refers to the charge levied against a party for borrowing money, which can be either a cost or a means of making profit for a trader. The amount that a lender charges to a borrower for the loan of an asset, usually expressed as a percentage of the amount borrowed. That percentage usually refers to the amount being paid each year known as annual percentage rate, or APR but can be used to express payments on a more or less regular basis.

In investing, intrinsic value can have two different meanings. When a company embarks on an IPO which stands for initial public offering it goes public on a stock exchange. Leverage is a concept that can enable you to multiply your exposure to a financial market without committing extra investment capital.

Leveraged products are financial instruments that enable traders to gain greater exposure to the market without increasing their capital investment. They do so by using leverage. They are the opposite of assets. LIBOR, or the London Interbank Offered Rate, is a benchmark that dictates daily interest rates on loans and financial instruments around the world. A limit order is an instruction to your broker to execute a trade at a particular level that is more favourable than the current market price.

Limit up and limit down are the maximum amounts a commodity future may increase limit up or decrease limit down in any single trading day. In investment, liquidity is the ease of buying or selling a particular asset in the market without affecting its price. It can also refer to the facility of converting an asset to cash quickly and easily.

M2 is a measure of money supply, referring to a certain portion of the money contained in an economy. Maintenance margin is the amount that must be available in funds in order to keep a margin trade open. It is also known as the variation margin. A margin call is the term for when a broker requests an increase maintenance margin from a trader, in order to keep a leveraged trade open. It is also referred to as market cap.

In investments, market data is the data reported on various assets and financial instruments by trading companies and exchanges. Market can have several meanings within investments. Generally it is defined as a medium through which assets are traded, with their value determined by supply and demand. A market maker is an individual or institution that buys and sells large amounts of a particular asset in order to facilitate liquidity.

A market order is an instruction from a trader to a broker to execute a trade immediately at the best available price. A moving average often shortened to MA is a common indicator in technical analysis, used to examine price movements of assets while lessening the impact of random price spikes. Multilateral trading facilities MTFs offer traders and investment firms an alternative to traditional exchanges. They allow trading of a wider variety of markets than most exchanges, including assets that may not have an official market.

The multiplier effect is an economic term for when changes in money supply are amplified from the knock-on effects of economic activity. It is a commonly used method of quoting the price movements of stocks and funds. Net income is the total amount of profit often known as earnings made by a company, listed in its earnings report. Non-farm payrolls are a monthly statistic representing how many people are employed in the US, in manufacturing, construction and goods companies.

They can also be known as non-farms, or NFP. Offer is the term used when one trader expresses an intention to buy an asset or financial instrument from another trader or institution. On exchange is a term used to mean that a trade is taking place directly on an order book. It differs from at quote, which is a trade made at the price quoted by a market maker. OPEC stands for the Organisation of Petroleum Exporting Countries.

Open has several definitions within investing. It can refer to the daily opening of an exchange, and an order or position that has not yet been filled or closed. Your open positions are the trades you have made that are still able to incur a profit or a loss. When a position is closed, all profits and losses are realised and the trade is no longer active.

An option is a financial instrument that offers you the right — but not the obligation — to buy or sell an asset when its price moves beyond a certain price with a set time period. An option spread is a strategy used in options trading. It involves buying and selling multiple options on the same underlying asset that are almost identical to each other but with a different strike price or expiry.

In trading, an order is a request sent to a broker or trading platform to make a trade on a financial instrument. OTC stands for over-the-counter, and refers to a trade that is not made on a formal exchange.

It is often also referred to as off-exchange trading. The term for when a trader makes the technical mistake of investing too much in a particular opportunity. It is calculated as its share price divided by earnings per share EPS. A pip is a measurement of movement in forex trading, defined as the smallest move that a currency can make. PMI stands for purchasing managers index, a useful indicator of health in a particular sector within an economy.

In the UK, Markit produce a PMI for the manufacturing, services and construction industries. A position is the financial term for a trade that is either currently able to incur a profit or a loss an open position or has recently been cancelled a closed position. Positions are the way in which a trader will hope to make a profit. Power of attorney gives another person the ability to act on your behalf.

In trading, this means they can take over your trading accounts. Profit and loss are two terms that are central to trading: Puts are a variety of option that give the purchaser the right, but not the obligation, to sell an asset at a certain price before the option expires.

Quantitative easing or QE, for short is an economic monetary policy intended to lower interest rates and increase money supply. It saw an increase in profile and use after the financial crash and subsequent recession. The quote currency is the second currency listed in a forex pair.

It is also known as the counter currency. In trading, the quote is the price at which an asset was last traded, or the price at which it can currently be bought or sold.

A rally is a period in which the price of an asset, market or index sees sustained upward momentum. Typically, a rally will arrive after a period in which prices have been flat or in a decline.

Glossary of Trading Terms & Definitions | Financial Terms Explained | IG UK

It is mostly used as an indicator of volatility: A ratio spread is a strategy used in options trading, in which a trader will hold an unequal number of buy and sell options positions on a single underlying asset at once. Reserves are the liquid assets set aside for future use by an individual, central bank or business.

Usually they are in the form of currency or a commodity, such as gold. For traders, reserves will usually be kept as cash that can be accessed quickly. A resistance level is a key tool in technical analysis, indicating when an asset has reached a price level that market participants are unwilling to surpass. A reversal is a turnaround in the price movement of an asset: They can also often be referred to as trend reversals. A rights issue is the term for when a company offers more of its shares to current shareholders, usually to raise extra capital.

It differs from other additional shares offerings, where shares are available for any investor willing to buy. Risk management is the process of identifying potential risks in your investment portfolio, and taking steps to mitigate accordingly. RNS is short for the Regulatory News Service, a part of the London Stock Exchange. The RNS sends regulatory and non-regulatory information on behalf of businesses and other companies, helping them to comply with the disclosure obligations set out by regulators around the world.

ROCE stands for return on capital employed: RSI stands for the relative strength index. It is a key tool used in technical analysis, assessing the momentum of assets to gauge whether they are in overbought or oversold territory.

A scalp in trading is the act of opening and then closing a position very quickly, in the hope of profiting from small price movements. The SEC stands for the US Securities and Exchange Commission. It is a government agency set up to regulate markets and protect investors in the United States, as well as overseeing any mergers and acquisitions.

Sectors are divisions within an economy or market, useful for analysing performance or comparing companies with similar outputs and characteristics. Shares are the units of the ownership of a company, usually traded on the stock market. They are also known as stocks, or equities. Shares trading is the buying and selling of company stock — or derivative products based on company stock — in the hope of making a profit. In trading, short describes a trade that will incur a profit if the asset being traded falls in price.

It is also often referred to as going short, shorting or sometimes selling. Short selling is the act of selling an asset that you do not currently own, in the hope that it will decrease in value and you can close the trade for a profit. It is also known as shorting. When the price at which an order is executed does not match the price at which it was made, it is referred to as slippage. A smart order router SOR is an automated process used in online trading that follows a set of rules when looking for trading liquidity.

The goal of an SOR is to find the best way of executing a trade. Socially responsible investing, or ethical investing, is an investment strategy that seeks to return profit while taking the wider ethical implications of investments into account.

In trading, spot refers to the price of an asset for immediate delivery, or the value of an asset at any exact given time. Spread betting is a leveraged financial derivative. When spread betting, you are making a bet on the direction in which a market will move.

The accuracy of your bet determines the profit or loss when the position is closed. In finance, the spread is the difference in price between the buy bid and sell offer prices quoted for an asset. Stock analysis is the examination and evaluation of the stock market. It can take the form of analysis of an individual stock, sector or broader areas.

Stock analysis is also referred to as market analysis, or equity analysis. A stock index is a group of shares that are used to give an indication of a sector, exchange or economy. Usually, a stock index is made up of a set number of the top shares from a given exchange.

A stock symbol is a unique series of letters or numbers, used to identify a stock traded on a stock exchange. They are also sometimes referred to as stock tickers or ticker symbols. Stockbroking is a service which gives retail and institutional investors the opportunity to trade shares. Stop orders are types of order that instruct your broker to execute a trade when it reaches a particular level: They can also be known as stop-loss orders.

A straddle is a type of options trading strategy that allows traders to speculate on whether a market is about to become volatile or not, without having to predict a specific price movement. Straddles involve either buying or selling simultaneous call and put options with matching strike prices and expiration dates.

In options trading, the strike is the price at which a contract can be exercised, and the price at which the underlying asset will be bought or sold. It is also known as the strike price. A support level is the price at which an asset may find difficulty falling below as traders look to buy around that level.

Tangible assets are the assets on a company's books and balane sheet that have a physical form. They comprise the machinery, office equipment and buildings used by a company fixed assets and of the materials that are used in producing products current assets. It is one of the two major schools of market analysis, with the other being fundamental analysis.

Tom-next is short for tomorrow-next day, the means by which forex speculators avoid taking physical delivery of currency and are able to keep forex positions open overnight. A trading floor is the area of a business or an exchange where assets are bought and sold, most commonly associated with stock exchanges and futures exchanges.

It is also often referred to as a trading pit. A trading plan is a strategy set by the individual trader in order to systemise evaluation of assets, risk management, types of trading, and objective setting. Most trading plans will comprise two parts: A trailing stop is a type of stop-loss that automatically follows positive market movements of an asset you are trading.

If your position moves favourably but then reverses, a trailing stop can lock in your profits and close the position. The shares do not count towards the total amount of outstanding shares listed, and neither pay dividends nor carry voting rights because a company cannot pay itself, or own itself. When a market is making a clear, sustained move upwards or downwards, it is called a trend. Identifying the beginning and end of trends is a key part of market analysis.

Trends can apply to individual assets, sectors, or even interest rates and bond yields. The trend can be either upwards or downwards. Unborrowable stock is the stock that no one is willing to lend out to short sellers. When shares in a company become unborrowable, the traditional means of short selling them is impossible. Variable costs are business expenses that change when production volumes change. They differ from fixed costs, which remain constant if production volume rises or falls.

VIX is short for the Chicago Board Options Exchange Volatility Index. In trading, volume is the amount of a particular asset that is being traded over a certain period of time. VWAP stands for volume weighted average price, a trading benchmark that is often used by passive investors. A working order is a general term for either a stop or limit order to open.

It is used to advise your broker to execute a trade when an asset reaches a specific price. WTI stands for West Texas Intermediate occasionally called Texas Light Sweet , an oil benchmark that is central to commodities trading. Yield is the income earned from an investment, most often in the form of interest or dividend payments. Yield is one of the ways in which investments can earn a trader money, with the other being the eventual closing of a position for profit.

Spread bets and CFDs are leveraged products and can result in losses that exceed deposits. The value of shares, ETFs and ETCs bought through a share dealing account, a stocks and shares ISA or a SIPP can fall as well as rise, which could mean getting back less than you originally put in. Please ensure you fully understand the risks and take care to manage your exposure.

CFD, share dealing and stocks and shares ISA accounts provided by IG Markets Ltd, spread betting provided by IG Index Ltd. IG is a trading name of IG Markets Ltd a company registered in England and Wales under number and IG Index Ltd a company registered in England and Wales under number Registered address at Cannon Bridge House, 25 Dowgate Hill, London EC4R 2YA. Both IG Markets Ltd Register number and IG Index Ltd Register number are authorised and regulated by the Financial Conduct Authority.

Excludes binary bets, where IG Index Ltd is licensed and regulated by the Gambling Commission, reference number IG Index supports responsible gambling, for information and advice please visit www.

Create account Login Menu Menu. IG Live Help Contact. Education Glossary of trading terms. Learn to trade Trading seminars and webinars Introduction programme Monthly newsletter IG Academy app. All trading involves risk. Losses can exceed deposits. Glossary of trading terms All trading involves risk. Take a look at our list of the financial terms associated with trading and the markets. A Back to the top. At the money definition. B Back to the top.

Blue chip stocks definition. The BoE is a popular shortening of the Bank of England, the central bank of the United Kingdom. C Back to the top. Contracts for difference, or CFDs, are a type of financial derivative used in CFD trading.

Cost of carry definition. D Back to the top. In spread betting, DFB stands for daily funded bet. Digital s trading definition. Digital trading is a type of trading that involves utilising digital options. E Back to the top. Earnings per share definition. F Back to the top. G Back to the top. Gross margin is a way of measuring the amount of profit a company can make from its revenue. H Back to the top. High frequency trading definition. I Back to the top.

In the money definition. L Back to the top.

A lot is a standardised group of assets that is traded instead of a single asset. M Back to the top.

Forex (FX)

In trading, margin is the funds required to open and maintain a leveraged position. When two or more companies decide to combine and become one entity, it is called a merger.

MetaTrader is an electronic trading platform which is popular among traders around the world. Multilateral trading facilities definition. N Back to the top. O Back to the top. Out of the money definition. P Back to the top. The term parity can be used in a few ways when trading, but always as an expression of equality.

Pip value is the value attributed to a one-pip move in a forex trade. Power of attorney definition. Profit and loss definition. Q Back to the top. R Back to the top.

In trading, risks are the ways in which an investment can end up losing you money. In trading, a rollover is the process of keeping a position open beyond its expiry. S Back to the top. Smart order router definition. SNB stands for Swiss National Bank, the central bank for Switzerland. A stock exchange is a medium by which shares are bought and sold. Sunday trading with IG definition.

Sunday trading is a service that enables you to speculate on several markets over the weekend. T Back to the top. U Back to the top. V Back to the top. W Back to the top. Y Back to the top. Contact us We're here 24hrs a day from 8am Sunday to 10pm Friday, and 9am to 5pm Saturday. Markets Forex Indices Shares Digital s Other markets.

Trading platforms Web platform Trading apps Advanced platforms Compare features. IG analysis The week ahead Market news IG Live. Contact us New client: Facebook Twitter LinkedIn Google Plus.