Difference between stock options rsu

What Is the Difference Between a Restricted Stock Unit and a Restricted Stock Award? -- The Motley Fool

Posted on February 1, by Rick Rodgers. I met with a client recently who was given the choice of receiving the equity portion of his compensation as a percentage of stock options or restricted stock unit RSUs.

An RSU is a grant valued in terms of company stock, but company stock is not issued at the time of the grant. After the recipient of a unit satisfies the vesting requirement, the company distributes shares or the cash equivalent of the number of shares used to value the unit. Depending on plan rules, the employee or employer may be allowed to choose whether to settle in stock or cash. The most important variable is how the equivalent number of options is set to RSUs.

Tax Treatment of Restricted Stock Unit (RSU) Benefits | Canadian Capitalist

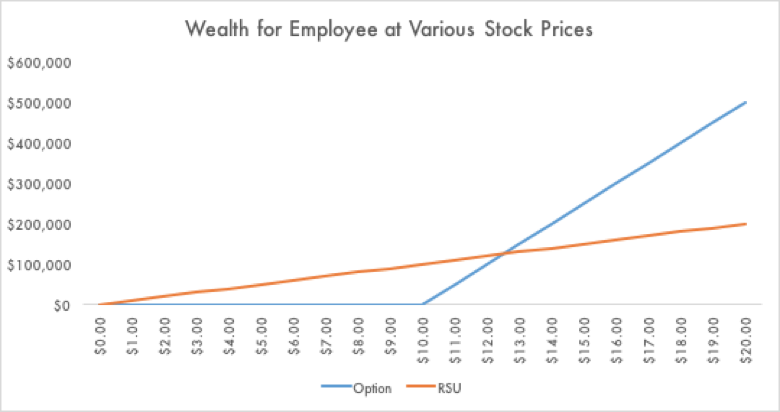

RSUs are preferred if the same number of options are offered. However, most companies typically offer a third to a fifth of the number of RSU shares than they would have granted in options.

Stock Options Vs. RSUs | Finance - Zacks

This is because the options are worthless if the share price never gets above the grant price during the vesting period. RSUs have greater downside protection but they also limit your upside if you have more options than RSUs.

RSUs are taxed in much the same manner as actual restricted shares. There is no capital gains treatment available at exercise. Employees are taxed at ordinary income rates on the amount received on the vesting date, based on the market value of the stock.

The employees may have to make payments of unnecessary taxes under Section 83 b election if the stock price declines. Taxation of options depends on whether they are incentive stock options ISO or non-qualified stock options NQSO. The rules regarding the taxation of ISOs are complex, especially on the alternative minimum tax.

The tax treatment for NQSOs is relatively straightforward.

Error (Forbidden)

Complexity abounds with respect to a RSU or option decision. Employees facing this decision should seek a competent financial adviser knowledgeable about these issues.

No one wants to run out of money. We assist our clients in all aspects of investment, tax, risk management, retirement, and estate planning.

About Team Contact Client Login. Will Your Money Last Through Retirement? Will I be able to maintain my current lifestyle? What will my monthly income be in retirement? Can I protect my hard-earned savings and still have the income I want? Receive Useful Retirement Planning Tips in Your Inbox Twice a Month.