Can you write a cashiers check to cash

Many of the offers appearing on this site are from advertisers who compensate us to be listed on our site. Compensation may impact which products we review and write about and how and where they appear on this site including, for example, the order in which they appear.

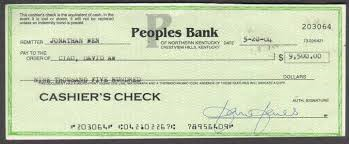

Any evaluation, advice, opinion or guidance provided by us or editorialized by us within this website such as bank reviews, product reviews or editorial content is in no way affected by or based upon compensation from our advertisers. The most important difference from a regular check is that the bank guarantees its payment, not the purchaser.

You may need to open a checking account. The bank certifies that the signature is genuine and that the customer had sufficient funds to cover the check when it was issued. Money orders may have limits on their value, such as the U. At least a few charge a percentage of the check amount.

Information about these fees and related policies can usually be found in the checking rates and fees pages that most institutions publish on their websites. This also helps prevent scams. If you do receive one, wait to use the funds until several days after the check has been deposited, or check with your bank to make sure it has forex deal butler indicators The bond, which is not that easy to get, makes you liable for the replacement check, according to the U.

Office of the Comptroller of the Currency. The bank regulator recommends contacting an insurance broker for help.

Even with the bond, the bank may require that you wait more than a month how to use kohls cash register a replacement check. When you purchase one of these checks from a bank or credit unionall parties can be confident that the transaction is secure and the risk of theft or fraud is minimal.

Thousands of people like you use NerdWallet every day to find the right bank or credit union. Your reviews help them decide. NerdWallet strives to keep its information accurate and up to date. All financial products, shopping products and services are presented without warranty. Pre-qualified offers are not binding.

So how do we make money? We receive compensation from our partners when someone applies or gets approved for a financial product through our site.

But, the results of our tools like our credit card comparison tool and editorial reviews are based on quantitative and qualitative assessments of product features — nothing else. Log in Sign up. When You Need One, How to Get It. Leave your own review. OUR FAVORITE CHECKING ACCOUNTS OUR FAVORITE CHECKING ACCOUNTS.

10 tips to help you write a cheque correctly - Banking BasicsOUR FAVORITE ONLINE CHECKING ACCOUNTS OUR FAVORITE ONLINE CHECKING ACCOUNTS. Checking Accounts Savings Accounts CD Rates.

Personal Finance What Is a Cashier's Check and How Do I Get One? - The Simple Dollar

Best Checking Accounts Best Savings Accounts Bank Reviews. Compound Interest Calculator 4 Steps to Switch Banks The Best Credit Cards Home Affordability Calculator Personal Loan Rates Student Loans.

Cashier's Checks - Overview, Fees, and Safety

Nerdwallet Newsletter Sign up to get the latest money-saving tips, deals and advice. We want to hear from you and encourage a lively discussion among our users. Please help us keep our site clean and safe by following our posting guidelinesand avoid disclosing personal or sensitive information such as bank account or phone numbers.

Any comments posted under NerdWallet's official account are not reviewed or endorsed by representatives of financial institutions affiliated with the reviewed products, unless explicitly stated otherwise. Credit Cards Banking Investing Mortgages University Partners.

Insurance Loans Shopping Utilities Taxes. About Company Press Careers Leadership. Terms of Use Privacy Policy.