Setsqx trading system

SETS and SEAQ enable share trading to be carried out cheaply.

A company needs at least two market makers to be operating in order to be eligible for trading using SEAQ, and as such, SEAQ is really just a computer-based system by which the prices set by individual market makers are published and compared, and by which the best bid or ask price can be obtained by your broker.

SEAQ also largely removes the need for face-to-face bargaining on the stock exchange floor, with market makers using it themselves to buy and sell shares and so determine their bid and offer prices.

It used to cover larger companies but these days SEAQ is confined to around 1, or so of the least traded shares on the Alternative Investment Market AIM and fixed income securities. SETS was launched in , and was originally used to trade shares in the largest companies listed on the FTSE and some of the next largest group of companies on the FTSE Today, it has also been extended to include around companies, including many in the FTSE Small Cap index and the most heavily traded AIM shares.

Trading services - London Stock Exchange

The idea behind SETS is largely to minimise the the number of shares needed to be held by market makers using traditional systems in order to create a liquid market and guarantee that buyers and sellers can always find someone to buy from or sell to, and so reduce the risk faced by market makers, in turn reducing the costs needed to compensate for that risk.

For smaller companies traded using traditional systems, that would really not be effective which is where SEAQ comes in , but it is exactly how SETS works for companies that are widely traded.

The People's Cube - Political Humor & Satire

What your broker does is enter your order on the SETS system, and the system will match it to other individual investors wishing to buy or sell shares at the same time.

With such largely traded stocks as those found on the FTSE , it can be pretty much guaranteed that there is enough trading going on to find someone to sell shares to you, or buy them from you, in a very short space of time.

The Financial Times Guide to Investing: The Definitive Companion to - Glen Arnold - Google Livres

SETS might match your order up with several sellers who want to sell fewer shares, or take a portion of the shares that a larger seller wishes to dispose of. In doing so, SETS bypasses traditional market makers, and so reduces the spread between the bid and offer prices.

Sell Insurance Agency | Buy Insurance Agency

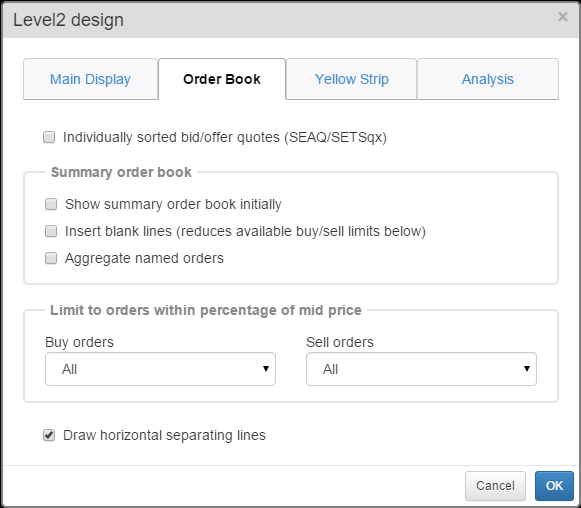

Since , SETS has been extended by the SETSqx system Stock Exchange Electronic Trading Service — quotes and crosses , which covers all main market stocks not covered by SETS, and a number of stocks quoted on the Alternative Investment Market AIM. SETSqx currently covers around 1, securities, effectively sitting between SETS and SEAQ. And that all adds up to a very good deal for individual small investors. The Motley Fool can help you invest better. We have several investing reports which are free to access and packed full of useful information on investing strategies and share ideas.

Click to find out more.

Help yourself with our FREE email newsletter designed to help you protect and grow your portfolio. So we can give you the most relevant experience, please tell us what phrase below best matches your investing style:.

By providing your email address, you consent to receiving further information on our goods and services and those of our business partners. To opt-out of receiving this information click here. All information provided is governed by our Privacy Statement. The Motley Fool, Fool, and the Fool logo are registered trademarks of The Motley Fool Holdings Inc. BATS Index provided by. Investing Basics How The Stock Market Works SETS and SEAQ Market Makers SETS and SEAQ How Do Share Markets Work?

Broker Forecasts The London Stock Exchange Rights Issues and Open Offers Share Buybacks Share Splits, Bonus Issues and Share Consolidations Takeovers and Mergers. How Do Share Markets Work? So we can give you the most relevant experience, please tell us what phrase below best matches your investing style: I mainly invest for Growth.

Claim your FREE report… The Fool's 5 Shares To Retire On. Anglo American ARM Holdings AstraZeneca Aviva BAE Systems Banking Barclays BHP Billiton BP Brexit British American Tobacco Centrica Diageo Dividends easyJet FTSE FTSE GlaxoSmithKline Glencore Growth HSBC HSBC Holdings Income Lloyds Banking Group Mining Morrisons National Grid NEXT Oil Persimmon Pharmaceuticals Premier Oil Prudential Rio Tinto Royal Dutch Shell Sainsbury's Sirius Minerals SSE Standard Chartered Supermarkets Tesco Tullow Oil Unilever Video Vodafone.

The Motley Fool Ltd.